Navigation :

test ../ test user-ref.html

User & Reference Guide

test ../ test getting-started.html

Getting started

test ../ test getting-started/overview.html

- Atoti Market Risk overview

test ../ test getting-started/data-model.html

- Market Risk Data Model

test ../ test getting-started/directquery.html

- DirectQuery

test ../ test getting-started/about.html

- Using this guide

test ../ test getting-started/whats-new.html

- What's New

test ../ test dashboards.html

Dashboards

test ../ test calculations.html

Calculations Guide

test ../ test calculations/component.html

- Component Measures

test ../ test calculations/corporate-actions.html

- Corporate Actions

test ../ test calculations/cross-sensitivity.html

- Cross sensitivity

test ../ test calculations/exchange-rate-and-market-data-api.html

- Exchange Rate and Market Data API

test ../ test calculations/fx-effect-on-var.html

- FX Effect on VaR

test ../ test calculations/fx-rates-service.html

- FX Rates Service

test ../ test calculations/incremental.html

- Incremental Measures

test ../ test calculations/lestimated.html

- LEstimated Measures

test ../ test calculations/parametric-var.html

- Parametric VaR

test ../ test calculations/pnl-explain.html

-

PnL Explain

test ../ test calculations/sensitivity-ladders.html

- Sensitivity ladders

test ../ test calculations/taylor-var.html

- Taylor VaR

test ../ test calculations/var-interpolation.html

- VaR Interpolation

test ../ test calculations/whs.html

- WHS

test ../ test cube.html

Cube Reference

test ../ test datastore.html

Datastores

test ../ test input-files.html

Input file formats

test ../ test properties.html

Properties

test ../ test what-if.html

What-If Analysis

test ../ test database.html

Database

test ../ test sign-off.html

Sign-Off Approvals

test ../ test limits.html

Limit monitoring

test ../ test dev.html

Developer Guide

test ../ test dev/dev-release.html

-

Release and migration notes

test ../ test dev/dev-getting-started.html

-

Getting Started

test ../ test dev/dev-ui-config.html

-

Configuring the UI

test ../ test dev/dev-mr-application.html

-

The Market Risk Application

test ../ test dev/dev-libraries.html

-

Market Risk Libraries

test ../ test dev/dev-extensions.html

-

Extending Atoti Market Risk

test ../ test dev/dev-tools.html

-

Configuring tools and methodologies

test ../ test dev/dev-sign-off.html

-

Sign-Off

test ../ test dev/dev-whatif.html

-

What-If

test ../ test dev/dev-direct-query.html

-

DirectQuery

test ../ test pdf-guides.html

PDF Guides

test ../ test market-data-api.html

Market-data-api

Incremental Measures

The Incremental measures evaluate the impact of a trade or a group of trades (‘current scope’) on the grand total result, by comparing it with a computation as if the given trade or aggregate of trades were hypothetically removed.

$$M^{incremental}(\text{scope})=M(\text{portfolio}) - M(\text{portfolio excl scope})$$

Example

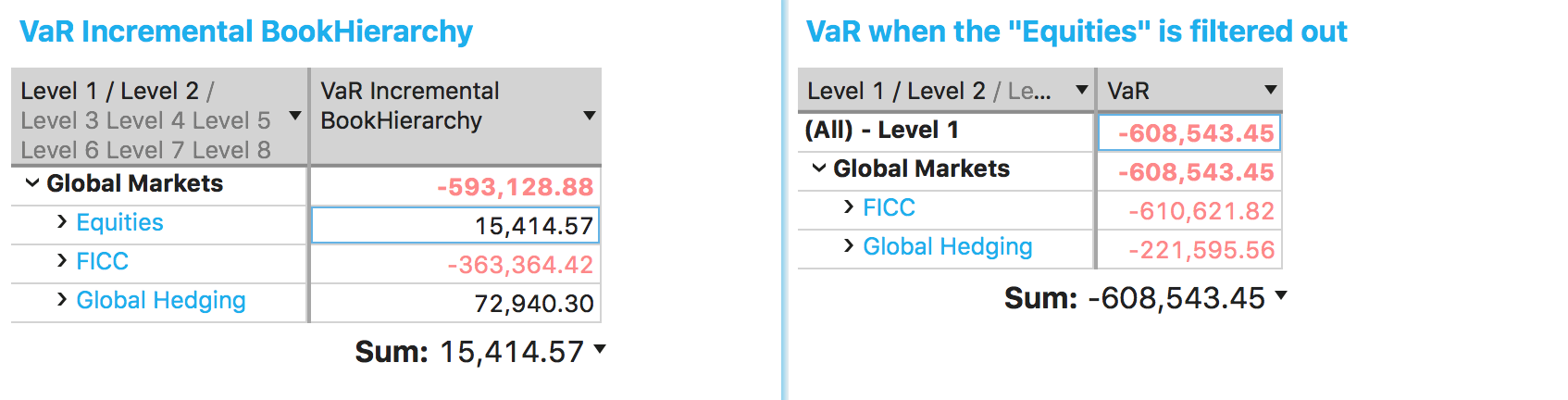

In the following example, the VaR Incremental BookHierarchy measure shows the impact of the three sub-portfolios on the firm-level VaR number.

The left pivot table shows that the VaR Incremental BookHierarchy for the business line “Equities” is +15.414, which means, that this portfolio has a positive +15.414 impact on the firm-level VaR

To validate the incremental measure for the business line “Equities”, let’s compute firm-level VaR with a filter excluding this node (on the right pivot table), then the VaR is -609k which is 15.414 lower (-593k - (-609k))

See also