Taylor VaR

Overview

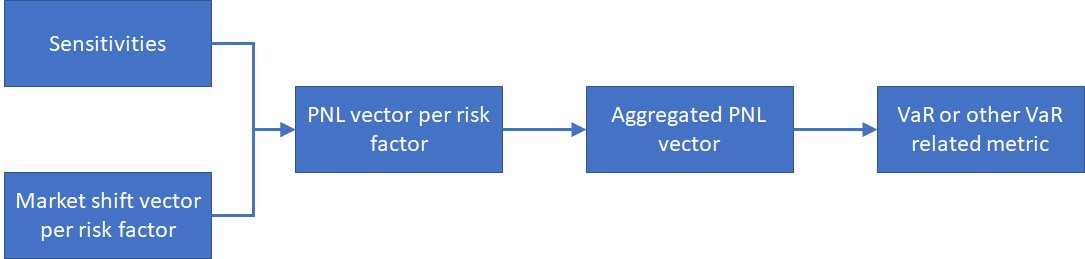

With the sensitivities it is possible to compute an approximated PnL of a product using the Taylor formula.

Cube process

In the cube, the PnL computation with the Taylor formula is not performed per trade, but instead per risk factor, by applying the Taylor part of the formula to this specific risk factor / market shift pair.

The applied formula is the same as the one used for the PnL Explain functionality.

As the next stage of the formula is purely linear, with the help of cube aggregation, we can output PnL per trade, risk factor, and so on.

The market shift is provided directly as a vector compatible with the VaR scenarios.

Sources

The risk factor values are read straight from the aggregated sensitivity metrics. The market shifts are loaded directly from the MarketShifts store.

Limitations

The market shifts must be the same kind as the sensitivity, that is, either absolute or relative.

Market Risk Accelerator Reference Guide v2.0.0

Market Risk Accelerator Reference Guide v2.0.0