FX Effect on VaR

Overview

Note, simply multiplying the PNL vector by the Spot does not produce the correct PNL vector in domestic currency.

The currency rate is a stochastic variable that has to be taken into account in the VaR computation. For each scenario of the PNL vector, you must use a specific exchange rate. This exchange rate must be consistent with the corresponding scenario.

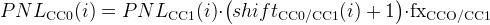

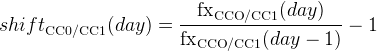

This will give us:

with the shift defined as

VaR computation and risk class

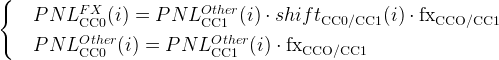

If the Risk Class axis is selected, we must split the VaR between the FX risk class and the underlying risk class.

So the VaR is split like this:

The name of the FX risk class is given by the parameter

risk.class.member.fx=FX

The FX exchange produces an effect on VaR only if the RiskFactorId column is set in the [FxRates] datastore, otherwise only the spot exchange rate conversion is applied.

Market Risk Accelerator Reference Guide v2.0.0

Market Risk Accelerator Reference Guide v2.0.0