ReferenceLevel

| Description | Specifies the level at which the charge is calculated for capital allocation |

|---|---|

| Variations |

The ReferenceLevel context value specifies the cube level at which the capital charge is calculated. This defaults to “Enterprise” representing the top of house. All capital allocations are relative to the ReferenceLevel.

You can select a level from the drop-down list, the labels in the list can be read as follows:

- Desk@Desks stands for the level “Desk” in the hierarchy [Booking].[Desks]

- Level 5@BookHierarchy stands for level “Level 5” in the hierarchy [Organization].[BookHierarchy]

Once a specific level is selected, capital charges are computed for the members of this level and are then further allocated down to components according to a capital allocation methodology.

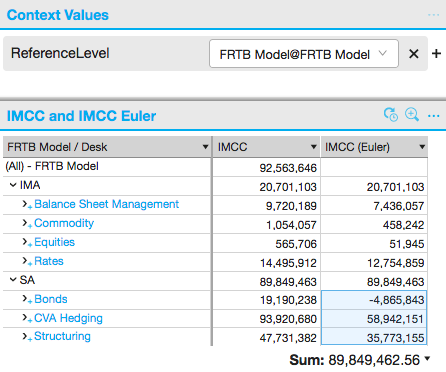

Consider the following example - Euler allocation of IMCC:

- IMCC measure computes the result for each individual cell as a standalone portfolio, for example, 20.7 mio is capital charge for a portfolio of all positions approved for IMA.

- **IMCC (Euler)** measures computes the result at the specified ReferenceLevel and then allocates the computed charges down to components.

In this example, [Booking].[FRTB Model] is the selected Reference level:

- The measures IMCC and IMCC (Euler) are equal for the rows “IMA” and “SA”, which are the members of the selected ReferenceLevel “FRTB Model”.

- Below the reference level, the measures are not equal: IMCC is computed for each contributing desk as a standalone portfolio, whereas IMCC Euler numbers for desks sum to the capital charge at the reference level - e.g. sum of Euler charges for “Bonds”, “CVA hedging” and “Structuring” under “SA” - is equal to the charge at the reference level “SA”.