What-If

What is the What-If?

The What-If functionality is an Accelerator add-on to the ActiveViam platform. It provides a consistent approach (including auditing and memory management) across all business solutions developed on top of the ActiveViam platform and is extendable and customizable. For example, the software allows a user to test the impact of a variety of scenarios that affect a bank’s risk-based capital charge.

How does it work?

On a daily basis, the production data set is loaded from a variety of sources, such as trade, reference, market data, and stored in an ActivePivot cube. This serves as the master data set from which all the potential scenarios or simulations evolve.

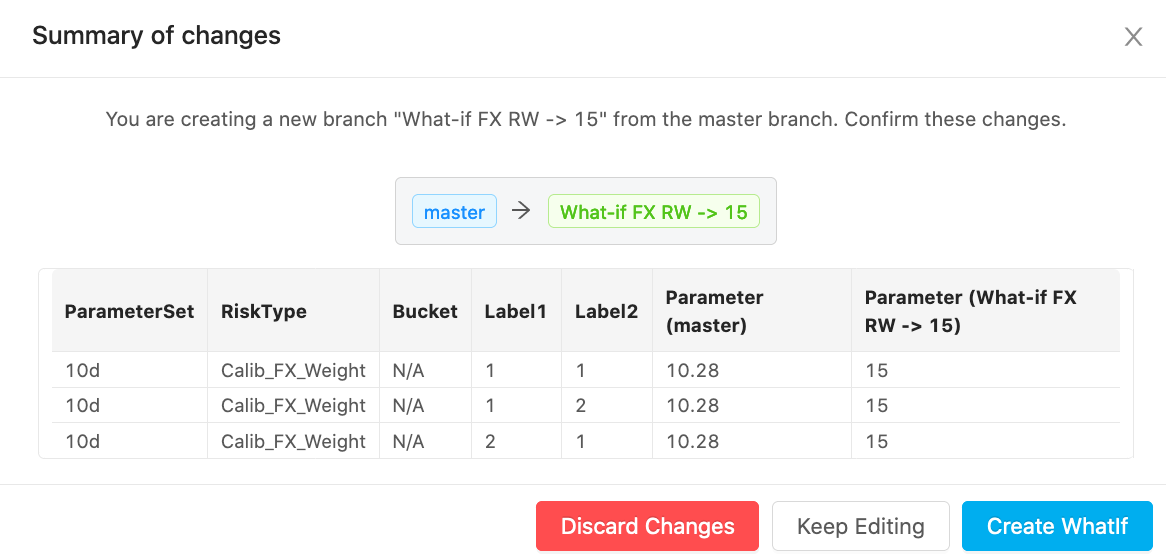

Once the What-If is initialized, the software allows you to apply certain changes to the risk data and parameters. These updates are reflected in a What-If branch of data that is created as an outgrowth of the master data set used to perform the what-if scenario.

In the screenshot, the capital calculations are displayed based on the data in the master branch, as well as in an experimental branch called WhatIf Fx RW -> 15, having the parameter Calib_FX_Weight increased by a user from 10.28 to 15.

The What-If functionality avoids the need to re-create massive sets of data and wait for the results. Rather, incremental updates are performed on the existing data sets and only those metrics that are impacted by any change in trade, reference, market data, and so on, are refreshed.

The use-cases supported by the SIMM Accelerator out-of-box1:

-

What-If simulations on calibration parameters. Users may override values of supervisory parameters and immediately visualise the impact on screen. Please refer to the Parameter Sets Widget documentation to learn more.

-

What-If on trade scaling. Users may apply scaling to one or more trades in an experimental mode.

-

What-If on File upload. Users may upload stress test sensitivities and modified calibration data into an experimental branch and evaluate what-if scenarios.

-

What-If on trade novation. Users may update a trade’s given portfolioId. By changing a trade’s portfolio, user can see a trade’s impact on the risk of

Any other What-If use-cases and features would be developed on a client implementation project and would not be part of the SIMM Accelerator.

-

the list of supported use-cases may be extended in future versions. ↩︎