FX calculation theory

The article presents the theory on how to calculate the PNL of a deal that is in position between two foreign currencies.

Sample deal

Let’s take a deal with the following attributes at t0 :

| Deal | Currency | RiskClass | RiskFactor | Value |

|---|---|---|---|---|

| Deal1 | CC1 | MtM [1] | 1000 | |

| Deal1 | CC2 | FX | Delta CC2 | 600 |

[1] MtM means Mark to Market, it is the current price of the product on the market. It means that the pricing of the product under market conditions will produce the MtM.

We have a deal that is evaluated at 1000 CC1 and with a sensitivity to CC2 of 600 CC1.

Market values

| FX rates | t0 | t1 |

|---|---|---|

| CC0/CC1 | 1.2 | 1.25 |

| CC0/CC2 | 10 | 9.8 |

| CC2/CC1 | 0.12 | 0.127551 |

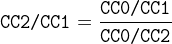

To calculate the 3rd currency exchange rate:

Here is the exchange rate conversion, the exchange rate name is the unit. So, multiplying n CC1 by CC0/CC1 gives CC0.

1 CC1 = 1.2 CC0

Conversion to Cash equivalent

To price this product, we will use a proxy that has the same characteristics on the market. In a perfect market this proxy must have the same price as the input product. We will use a basket of two currencies : CC1 and CC2.

| Fx | MtM | Delta | Total |

|---|---|---|---|

| CC1 | 1000 | -600 | 400 |

| CC2 | 72 | 72 |

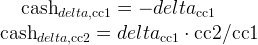

The cash from delta are calculated as follows:

Let’s check that it is correct at t0

For the MtM

| Currency | Cash | Cash in CC0 | MtM |

|---|---|---|---|

| CC1 | 400 | 480 | 1000 |

| CC2 | 72 | 720 | |

| Total in CC0 | 1200 | 1200 |

For the Delta

| Currency | Cash | Cash in CC1 | Cash in CC1 with CC2 + 1% | Delta |

|---|---|---|---|---|

| CC1 | 400 | 400 | 400 | |

| CC2 | 72 | 600 | 606 | |

| Total in CC1 | 1000 | 1006 | 6 / 1% = 600 |

PNL explain calculation

Let’s calculate the PNL explain from the cash equivalent at t1:

| Currency | Cash | Cash in CC0 | Cash in CC1 | Cash in CC2 |

|---|---|---|---|---|

| CC1 | 400 | 500 | 400 | 51.02 |

| CC2 | 72 | 705.6 | 564.48 | 72 |

| Total = MtM at t1 | 1205.6 | 964.48 | 123.02 | |

| MtM at t0 | 1200 | 1000 | 120 | |

| PNL | 5.6 | -35.52 | 3.02 | |

| Variation of MtM | 0.47% | -3.55% | 2.52% |

VaR calculation

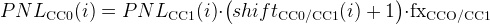

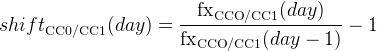

Simply multiplying the PNL vector by the Spot will not produce the right PNL vector in the domestic currency.

The currency rate is a stochastic variable that has to be taken into account in the VaR calculation.

For each scenario of the PNL vector, a specific exchange rate has to be used. This exchange rate must be consistent with the corresponding scenario.

This will give us :

with the shift defined as

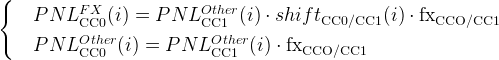

VaR calculation and risk class

If the Risk Class axis is selected we must split the VaR between the FX risk class and the underlying risk class.

So the VaR will be split as follows :

Related information

You can see the formula in Excel: FxCalculation.xlsx

Market Risk Accelerator v2.1

Market Risk Accelerator v2.1