Incremental Measures

The Incremental measures evaluate the impact of a trade or a group of trades (‘current scope’) on the grand total result, by comparing it with a computation as if the given trade or aggregate of trades were hypothetically removed.

$$M^{incremental}(\text{scope})=M(\text{portfolio}) - M(\text{portfolio excl scope})$$

Example

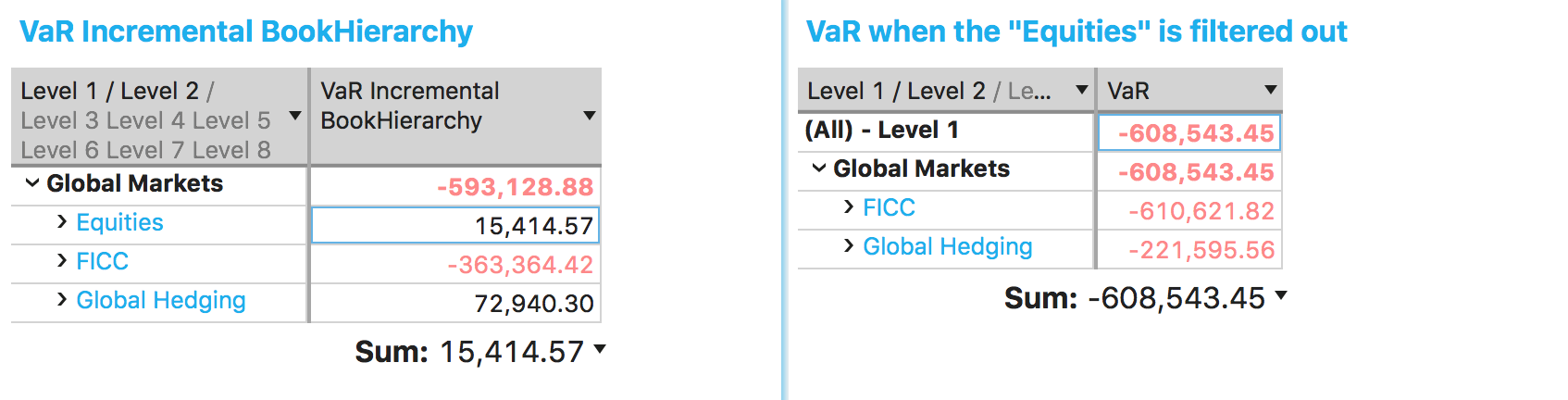

In the following example, the VaR Incremental BookHierarchy measure shows the impact of the three sub-portfolios on the firm-level VaR number.

- The left pivot table shows that the VaR Incremental BookHierarchy for the business line “Equities” is +15.414, which means, that this portfolio has a positive +15.414 impact on the firm-level VaR

- To validate the incremental measure for the business line “Equities”, let’s compute firm-level VaR with a filter excluding this node (on the right pivot table), then the VaR is -609k which is 15.414 lower (-593k - (-609k))

See also

- Component Measures (calculations)

- LEstimated Measures (calculations)

Market Risk Accelerator Reference Guide v1.9.1

Market Risk Accelerator Reference Guide v1.9.1