Viewing QIS Numbers

In this section, we explain how to view the Quantitative Impact Study figures using the “QIS” folder bookmarks.

Displaying the QIS bookmarks

The FRTB Accelerator comes with an analytical tool and a set of pre-defined bookmarks displaying the risk metrics. Ask your IT administrator for access to the application’s URL.

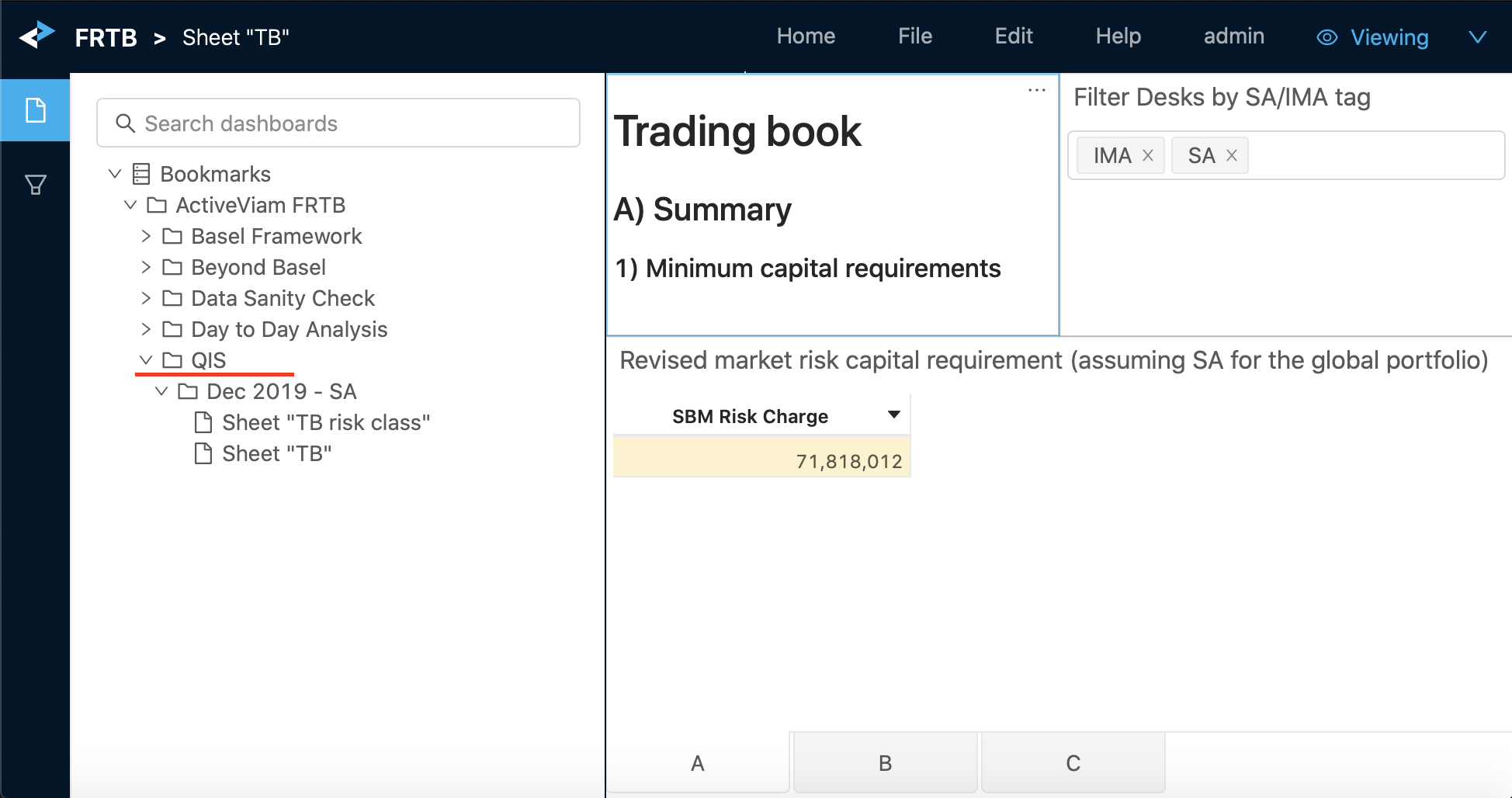

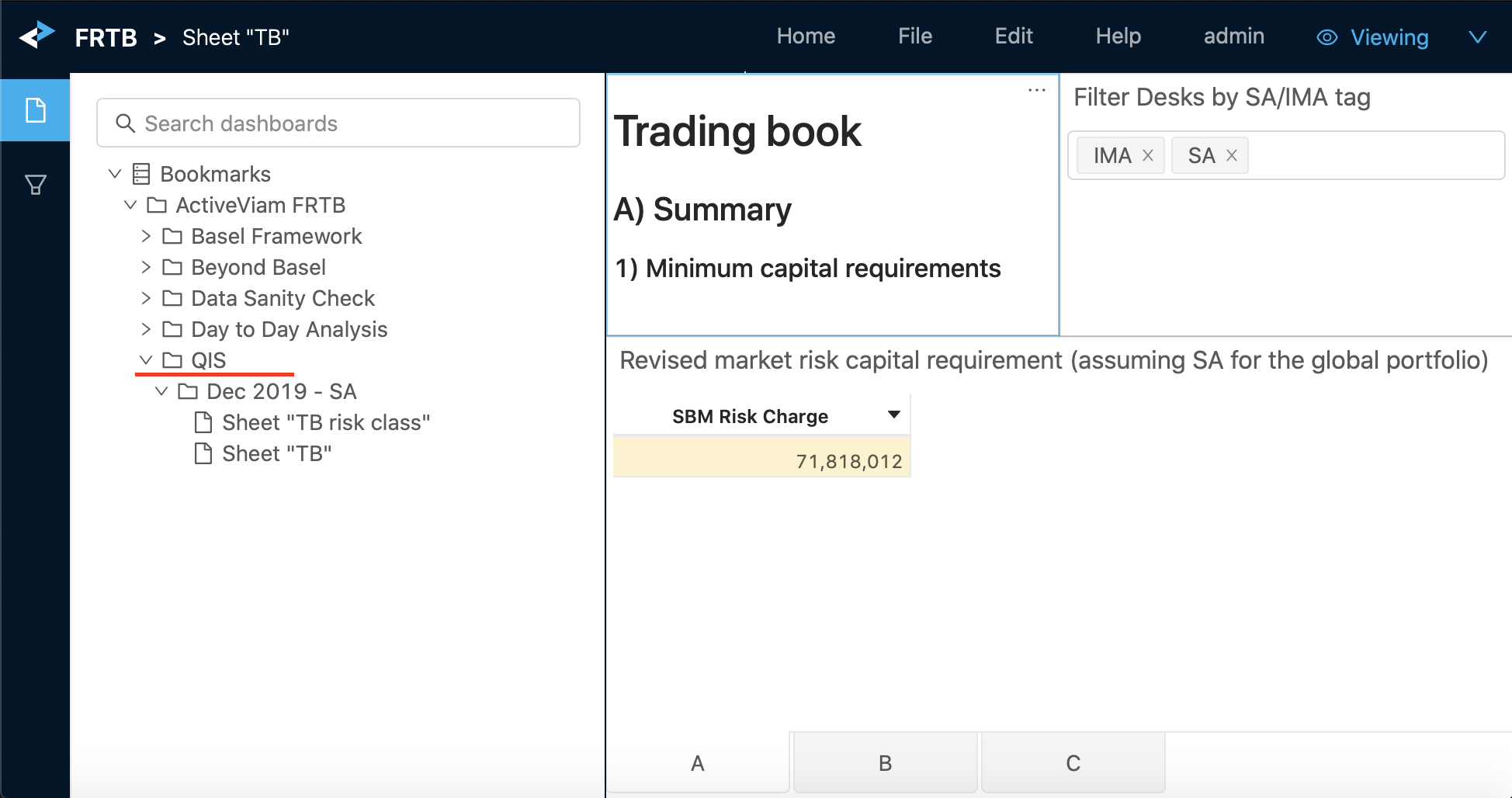

After you launch the application, click the bookmark icon on the left navigation bar to open the “Dashboards” tab. This presents the list of bookmarks available to you. In this tutorial we will talk about the QIS bookmarks:

In this version of the FRTB Accelerator we have pre-configured dashboards displaying the SA numbers. We have followed the QIS Excel template - “TB” and “TB risk class” tabs - as closely as possible to help you navigate and collect the capital numbers. But before we start looking at the dashboards, let’s talk about filtering and exporting the numbers.

How to check the filters

It is essential to understand the filters limiting the scope of data in the view.

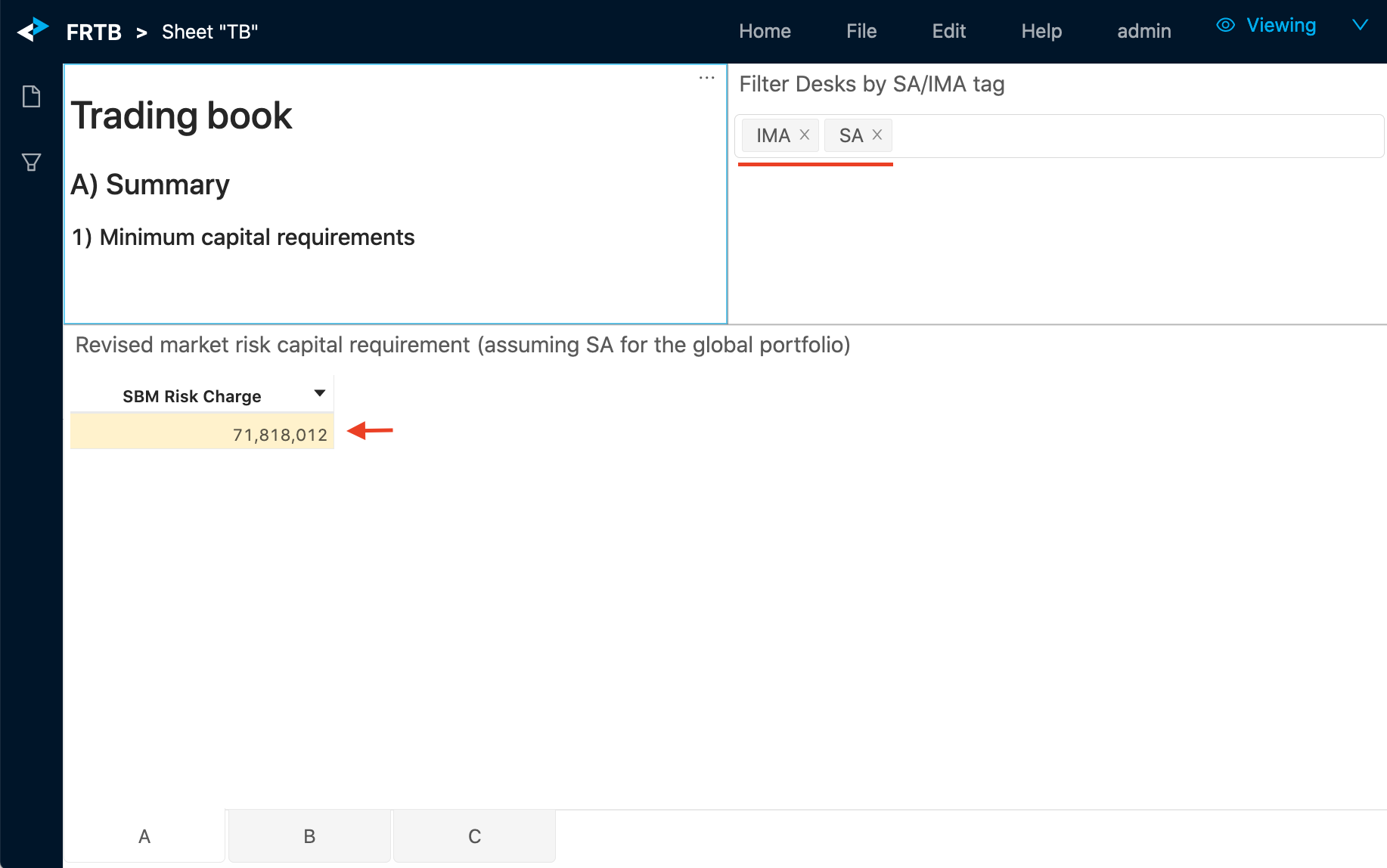

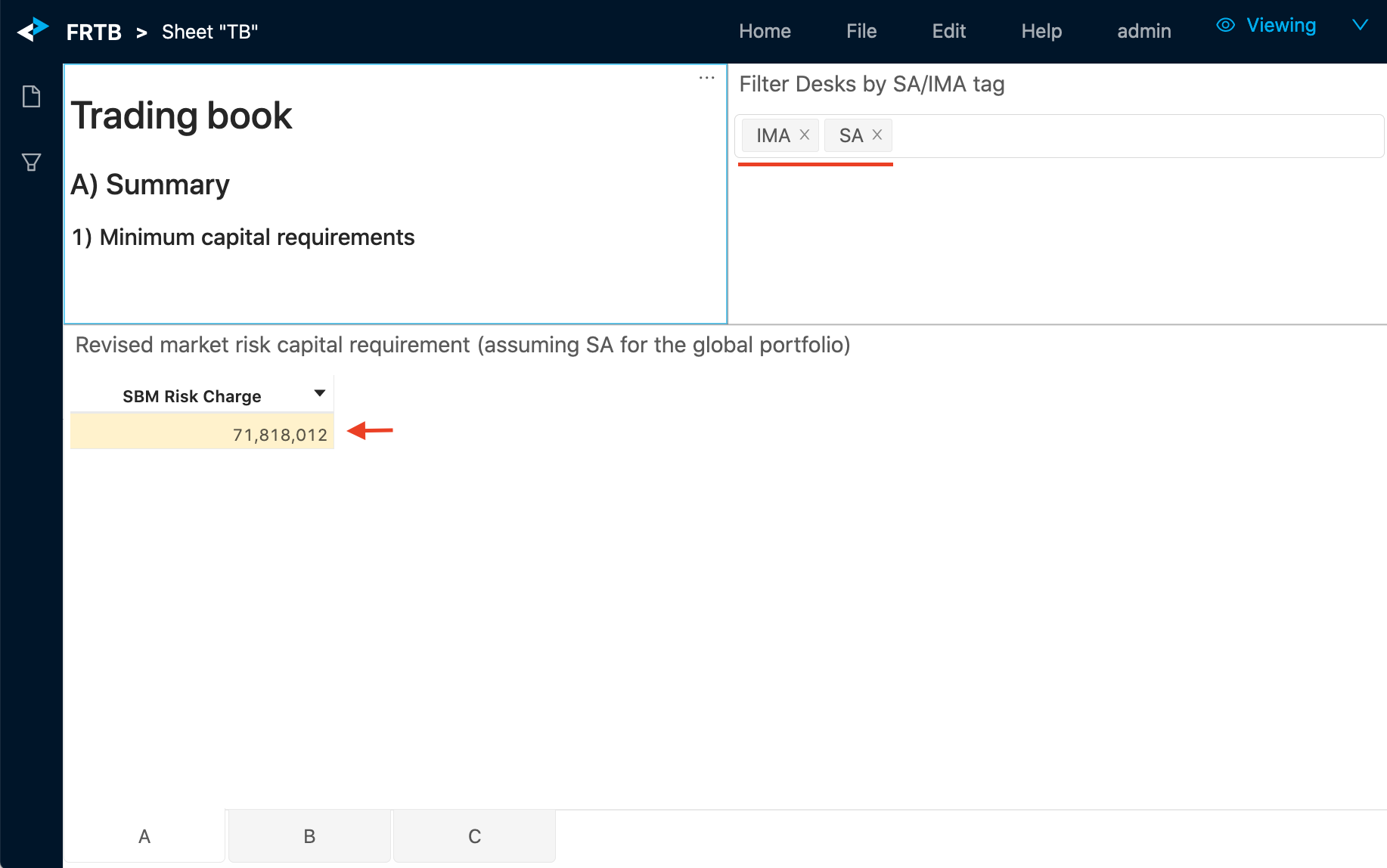

For example, at the top right of this dashboard you can find a quick filter on the “SA/IMA” FRTB approach:

It allows you to quickly set the scope of positions to those that are tagged for SA or IMA - and view the capital numbers for the updated scope. The mapping of positions to FRTB Approach comes from the Book structure.

Not all active filters will be displayed as a “quick filter” in a dashboard. You can inspect all the filters applied to your data by clicking the “Filters” drawer on the left navigation bar. For information on the filtering feature, see the ActiveUI User Documentation

How to export the numbers

Once you are comfortable with the numbers, you can export them.

- Right-click any data visualization widget and select either:

- Copy to clipboard. The content is recognized as a table by Excel. You can also use keyboard shortcuts to copy the selected range of cells. The column headers are also copied.

- Export to CSV file.

“TB” sheet

-

From the QIS folder, launch the Sheet “TB” bookmark. This dashboard helps you to fill in the “TB” sheet in the BIS Excel template.

-

Use tab A to capture the figures for section A 1) Revised market risk capital requirement (assuming SA for the global portfolio). Make sure you have the correct filters in the view:

-

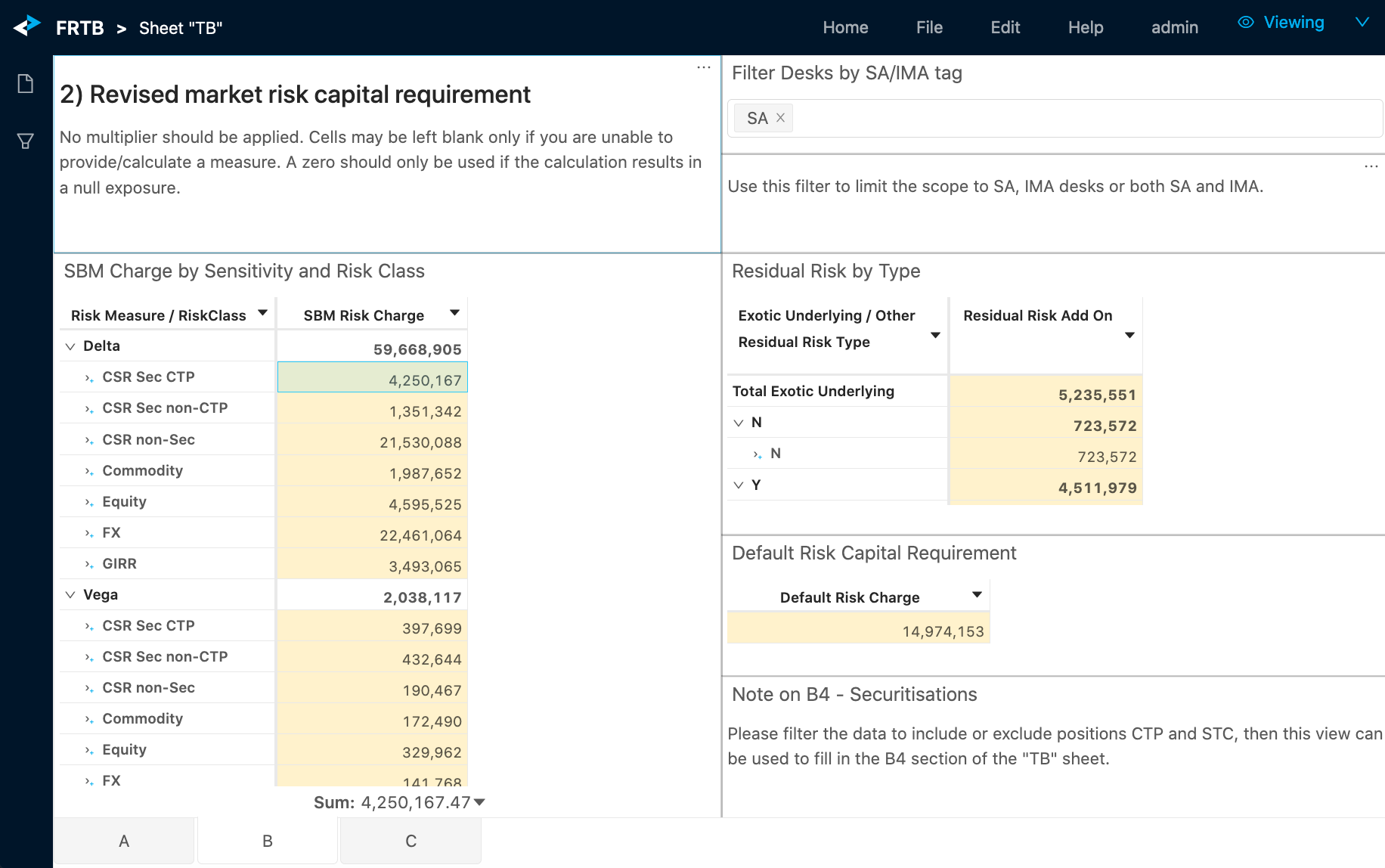

Use tab B to capture the figures for section B 2) Revised market risk capital requirement - SBM, RRAO and DRC SA.

The BIS template requires these two separate capital numbers:

- Assuming current model approval status, assuming all trading desks are in the BT and PLA test green zone

- Assuming current model approval status, reflecting the consequences of failing BT and PLA test

Therefore, consider using the Filtering feature described above and the book attributes delivered in the Book Parent Child file.

-

To fill in section 4) Securitisations (inclusive of hedges which, themselves, are not securitisations), filter the data in this view to include or exclude CTP and STC positions.

-

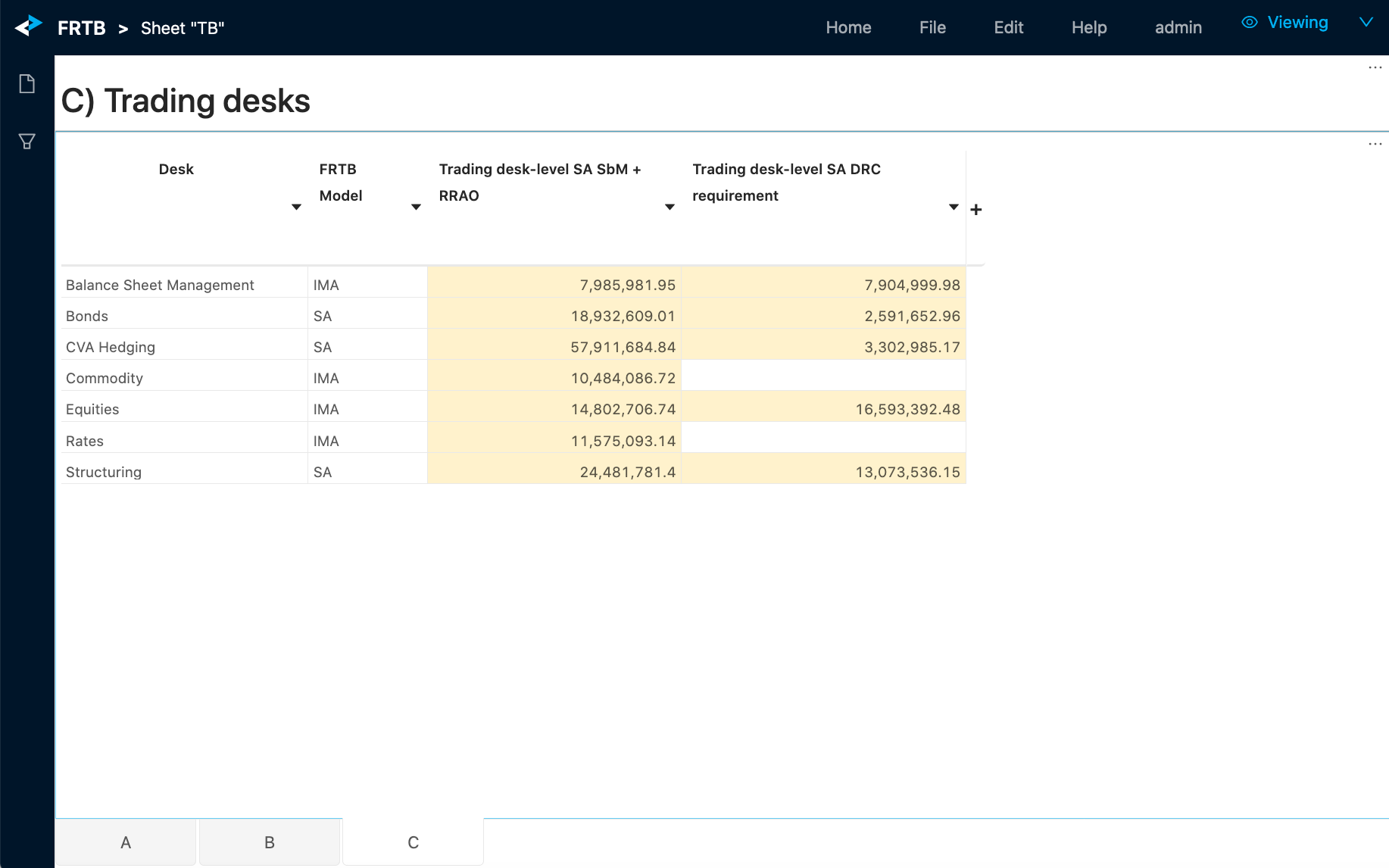

Use tab C to capture the desk-level capital numbers.

“TB risk class” sheet

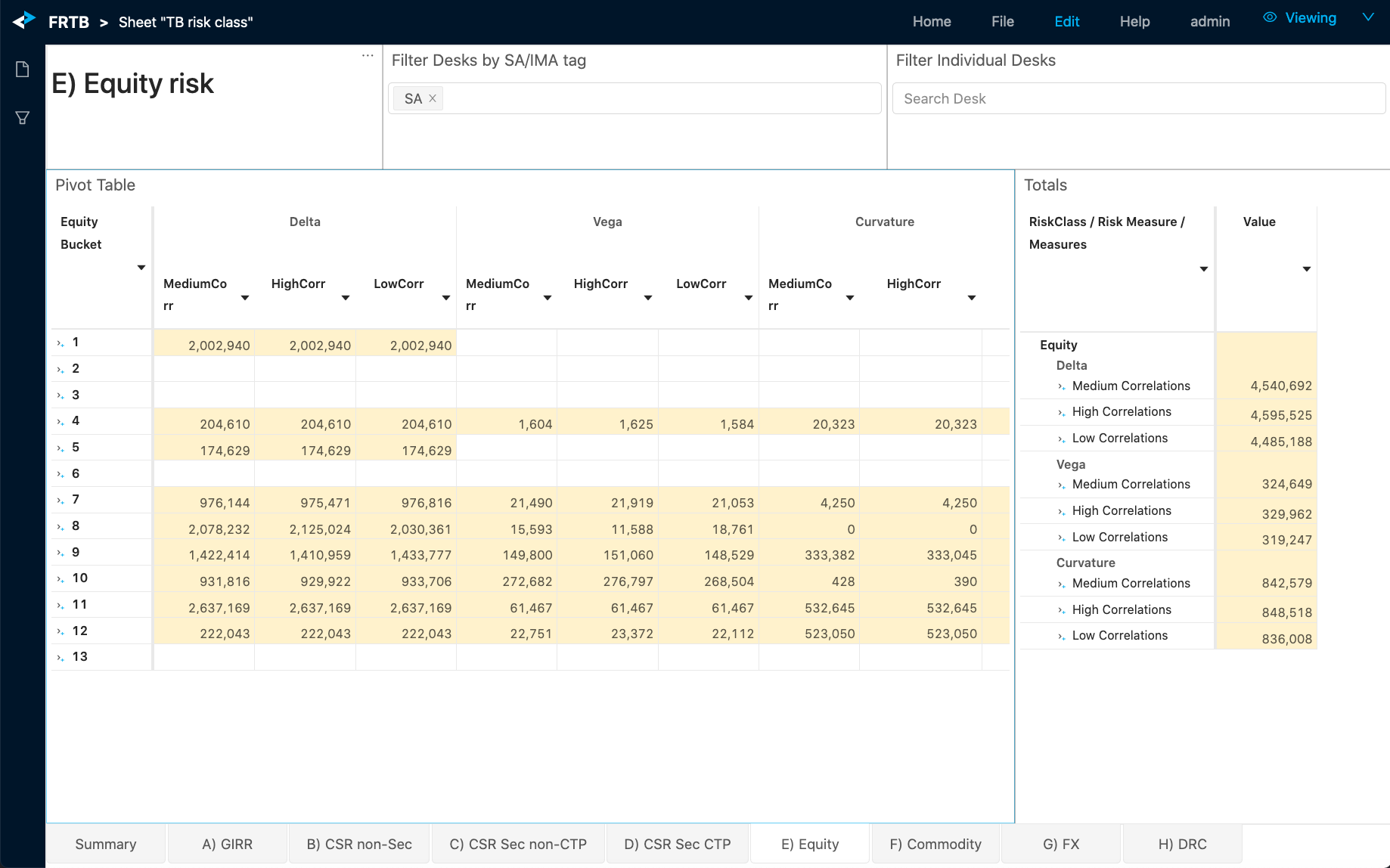

The Sheet “TB risk class” bookmark helps you to fill in the “TB risk class” sheet in the QIS Excel template. Each tab focuses on a certain risk class - GIRR, Equity, FX, etc. - and displays Delta, Vega, Curvature charges for different correlation scenarios, as well as total SBM charges. The last tab is dedicated to the DRC SA capital numbers.

Remember to keep checking the filters so that you can interpret the numbers correctly.

FRTB Accelerator Reference Guide v2.4.0

FRTB Accelerator Reference Guide v2.4.0