MDX examples to Run Non-trivial Analysis in ActivePivot

Advanced MDX Queries

With the MDX engine, business users can perform more complex queries without necessarily having to ask their IT team to write post-processors.

This section features some useful examples of using MDX to run non-trivial analysis in ActivePivot.

Books that Represent 80% of VAR

The TopCount function returns the specified number of elements with the highest values. But in some cases you may want to retrieve the members with the highest values that contribute to x% of the grand total. There is an MDX function for this: TopPercent

The following query retrieves the books with the highest VaR that contribute to 80% of the VaR of all the books.

SELECT

{

{[Book].[ALL].[AllMember]}

,TopPercent

(

[Book].[ALL].[AllMember].Children

,80

,[Measures].[historical.VaR]

)

} ON ROWS

FROM [VarCube]

WHERE

[Measures].[historical.VaR]

| Grand Total | 10,495.76 |

|---|---|

| Book_08 | 4,281.17 |

| Book_45 | 1,610.38 |

| Book_39 | 634.95 |

| Book_25 | 385.52 |

| Book_34 | 359.45 |

| Book_13 | 336.94 |

| Book_10 | 270.11 |

| Book_15 | 260.47 |

| Book_28 | 249.27 |

| Book_09 | 207.30 |

| Book_07 | 192.07 |

Calculated Measure Based on Member Value

This MDX query displays the value of contributors.COUNT in the newMeasure column if the BookId is 0 or 1,

otherwise pnl.SUM is displayed.

WITH

Member [Measures].[newMeasure] AS IIF(

[Bookings].CurrentMember IS [Bookings].[Desk].[DeskA].[0] OR [Bookings].CurrentMember IS [Bookings].[Desk].[DeskA].[1],

[Measures].[contributors.COUNT],

[Measures].[pnl.SUM]

)

SELECT NON EMPTY {

[Measures].[newMeasure],

[Measures].[contributors.COUNT],

[Measures].[pnl.SUM]

} ON COLUMNS,

NON EMPTY DrilldownMember(

[Bookings].[Desk].[DeskA],

{

[Bookings].[ALL].[AllMember].[DeskA]

}

) ON ROWS

FROM [EquityDerivativesCube]

| Measures | |||

| Desk ->BookId | newMeasure | contributors.COUNT | pnl.SUM |

| Total DeskA | -419221.5099999999 | 8312 | -419,221.51 |

| 0 | 858 | 858 | -55,139.82 |

| 1 | 818 | 818 | -30,642.60 |

| 2 | -44790.53999999996 | 871 | -44,790.54 |

| 3 | -26577.700000000044 | 743 | -26,577.70 |

| 4 | -32890.090000000026 | 863 | -32,890.09 |

| 5 | -41814.00000000004 | 840 | -41,814.00 |

| 6 | -52157.62999999997 | 862 | -52,157.63 |

| 7 | -32385.66999999997 | 833 | -32,385.67 |

| 8 | -30945.900000000016 | 806 | -30,945.90 |

| 9 | -71877.56000000001 | 818 | -71.877.56 |

Daily Turnover Change

With MDX functions like PrevMember and NextMember you can write formulas that compare the measure values between two days, weeks, months, or years.

For instance:

([Measures].[Turnover.SUM]/([Measures].[Turnover.SUM], [Time].CurrentMember.PrevMember) -1) * 100

where:

- [Measures].[Turnover.SUM] has the same value as ([Measures].[Turnover.SUM], [Time].CurrentMember) which is the turnover for the current member on the time dimension.

- ([Measures].[Turnover.SUM], [Time].CurrentMember.PrevMember) is the turnover for the member that precedes the current member on the time dimension.

- The final expression returns the relative growth between the two members:

- For the daily turnover change, put [Time].[Day].Members on one of the axes.

- For the monthly turnover change, put [Time].[Month].Members on one of the axes.

The final MDX query looks like this:

WITH

MEMBER [Measures].[Daily Turnover Change] AS

IIF

(

[Time].CurrentMember.PrevMember

IS NULL

,NULL

,

([Measures].[Turnover.SUM]/([Measures].[Turnover.SUM], [Time].CurrentMember.PrevMember) -1) * 100

)

SELECT

NON EMPTY

[Time].[Day].MEMBERS ON ROWS

FROM [Amazon]

WHERE

[Measures].[Daily Turnover Change]

IIf is used to handle the value of the formula for the first day. [Time].CurrentMember.PrevMember does not exist for the first day, it is null.

Date Ranges

Dates

All dates:

[AsOfDate].[AsOfDate].[AsOfDate].Members

All dates until:

[AsOfDate].[AsOfDate].[AsOfDate].[Wed Oct 17 00:00:00 CEST 2012] : null

All dates from:

null : [AsOfDate].[AsOfDate].[AsOfDate].[Wed Oct 17 00:00:00 CEST 2012]

Day to Day Differences

This section explains how to use MDX calculated members to compute differences between adjacent members. A typical example is the evolution of delta or pl from one business date to the next.

You can deploy the example here on the sandbox project by cutting and pasting the following MDX into the ActiveUI query editor.

The following table shows an MDX calculated member called DIFF, evaluated as the difference in delta.SUM from one member in the dates dimension to the next.

| 21-Jun-2012 | 20-Jun-2012 | 19-Jun-2012 | |

|---|---|---|---|

| DIFF | 17,730.64 | -74.090.05 | |

| delta.SUM | -364,364.78 | -346,635.14 | -420,725.19 |

The key MDX part to focus on is the definition of a calculated member (see the WITH MEMBER clause) called DIFF.

It is computed as the difference between the current value and the previous value. As the image shows, it is generic in that it works not only for T against T-1, but also across all pairs of members on the date dimension.

Another useful MDX feature is the FORMAT clause in the query.

WITH MEMBER [Measures].[DIFF] AS

IIF

(

[HistoricalDates].CurrentMember.PrevMember

IS NULL

,NULL

,

[Measures].[delta.SUM]

-

(

[Measures].[delta.SUM]

,[HistoricalDates].CurrentMember.PrevMember

)

)

,FORMAT = "#,###.00"

SELECT

NON EMPTY

{

[Measures].[DIFF]

,[Measures].[delta.SUM]

} ON ROWS

,NON EMPTY

Hierarchize

(

{

[HistoricalDates].[AsOfDate].MEMBERS

}

) ON COLUMNS

FROM [EquityDerivativesCube]

Using relative date functions

Using the PrevMember and NextMember functions makes your query dependent on the level comparator used for the AsOfDate

level. Plus, you may not have members for every day in a given period. For instance, only working days may be present, so you won't be able to compare delta.SUM on Monday because there is no data for the previous day.

To avoid these constraints, you can use specific MDX date functions.

Use case

You can create a measure in MDX that computes the difference of delta.SUM between today and yesterday, using the relative date functions DateDiff, DateAdd, and Now, which were implemented in version 4.4.6.

Query

WITH

Set [toto] AS Order(

Filter(

[Time].[HistoricalDates].[AsOfDate].Members,

IsDate(

[Time].[HistoricalDates].CurrentMember.MemberValue

) AND (

DateDiff(

"d",

[Time].[HistoricalDates].CurrentMember.MemberValue,

Now(

)

) = 1 OR DateDiff(

"d",

[Time].[HistoricalDates].CurrentMember.MemberValue,

Now(

)

) = 0

)

),

[Time].[HistoricalDates].CurrentMember.MemberValue

)

Member [Measures].[Diff btw Today - Yesterday] AS IIF(

Count(

[toto]

) = 2,

(

[Measures].[delta.SUM],

[toto].Item(

1

)

) - (

[Measures].[delta.SUM],

[toto].Item(

0

)

),

NULL

),

FORMAT_STRING="#,###.00"

SELECT NON EMPTY {

[Measures].[Diff btw Today - Yesterday]

} ON COLUMNS,

NON EMPTY Hierarchize(

[Bookings].[Desk].[BookId].Members

) ON ROWS

FROM (

SELECT [Bookings].[Desk].[ALL].[AllMember].[DeskA] ON COLUMNS

FROM [EquityDerivativesCube]

)

Explanation

First, create a Named Set composed of the two dates: today and yesterday. This is done by taking the members of the hierarchy for which the difference of days from Now (that is to say, the current time) is equal to 0 or 1.

Then it is sorted in descending order and we create a calculated member for the difference of delta.SUM between these two dates.

Result

| Measures | ||||||

|---|---|---|---|---|---|---|

| Desk | BookId | Diff btw Today - Yesterday | current delta.SUM | delta.SUM today - 1 | ||

| DeskA | 0 | 6 289,98 | -47 029,90 | -53 319,86 | ||

| 1 | -3 163,21 | -27 243,67 | -24 080,46 | |||

| 2 | -14 404,42 | -37 249,83 | -22 845,41 | |||

| 3 | 7 060,66 | 33 474,49 | 26 413,83 | |||

| 4 | 11 942, 06 | -61 702,55 | -73 644,61 | |||

| 5 | -1 013,81 | 43 947,61 | 44 961,42 | |||

| 6 | 4 206,75 | -55 789,63 | -59 996,38 | |||

| 7 | -4 151,88 | 2 800,65 | 6 952,53 | |||

| 8 | 7 953,25 | -38 842,98 | -46 796,23 | |||

| 9 | -12 674,60 | -21 805, 47 | -9 130,87 | |||

Changing

DateDiff("d", [Time].[HistoricalDates].CurrentMember.MemberValue, Now()) = 1 //difference is equal to 1

to

DateDiff("d", [Time].[HistoricalDates].CurrentMember.MemberValue, Now()) = 7 //difference is equal to 7

compares the current delta.SUM value to the one from seven days ago.

Furthermore, if it is Monday, you may want to compare the value to the previous one, which is the preceding Friday. To do that, you have to change a condition in the filter method:

Filter(

[Time].[HistoricalDates].[AsOfDate].Members,

IsDate([Time].[HistoricalDates].CurrentMember.MemberValue)

AND (

DateDiff("d", [Time].[HistoricalDates].CurrentMember.MemberValue, Now()) = IIf(Weekday(Now()) = 2, 3, 1) //The day

before or 3 days before if it's Monday (second week day)

OR

DateDiff("d", [Time].[HistoricalDates].CurrentMember.MemberValue, Now()) = 0

)

)

Distinct Count

The contributors.COUNT native measure counts the number of facts that contribute to a cell.

Often we are interested in counting at a higher level, for example:

- Number of (distinct) traders that have booked trades

- Number of (distinct) passengers that have been transported in a set of flights

This can done directly in MDX:

- List all the members to count, in the context of the currently evaluated cell. Use the DESCENDANTS function and the CurrentMember function to set the context.

- Count the members with the COUNT function, making sure you only count the non-empty ones (for which the current measure, or contributors.COUNT by default, returns something).

In the example below, for each traded product, we count the number of (distinct) desks where the product is traded.

WITH

Member [Measures].[Desk Count] AS Count(

Descendants(

[Bookings].[Desk].CurrentMember,

[Bookings].[Desk].[Desk]

),

EXCLUDEEMPTY

)

SELECT NON EMPTY Hierarchize(

DrilldownLevel(

[Underlyings].[Products].[ALL].[AllMember]

)

) ON ROWS

FROM [EquityDerivativesCube]

WHERE [Measures].[Desk Count]

You can also perform DISTINCT COUNT with a post-processor: the leaf count post-processor provides better performance, but the MDX approach is dynamic and available for all hierarchies. The post-processor must be configured and deployed with the cube.

Exclude an intersection of two hierarchies

- Use the Except and CrossJoin functions.

- Use Crossjoin in the first argument of the Except function to return all possible Tuples and then give the intersection (Tuple) that you want to exclude in the second argument.

- The result is a set that can then be used on a pivot axis.

Exclude intersection of Member A and Member B from the cross join of Hiearchy A and Hierarchy B

_______________________________________________________________________________________________

Except(

Crossjoin(

[Dimension A].[Hierarchy A].[Level A].Members,

[Dimension B].[Hierarchy B].[Level B].Members

),

(

[Dimension A].[Hierarchy A].[Level A].[Member A],

[Dimension B].[Hierarchy B].[Level B].[Member B]

)

)

see Working with Members, Tuples, and Sets (MDX).

Filter Dimension Members Based on Their Names

When you manipulate high cardinality dimensions, you may often want to focus only on particular subsets of members. The selection of those members might be tricky at times, based on particular naming conventions.

MDX allows you to create fine-grained selections by using the Filter function in association with the Caption function.

We can illustrate this use case against the ActivePivot sandbox by drilling down the PnL measure with respect to Underlyings.

Non-Filtered Members

SELECT

NON EMPTY Hierarchize({DrilldownLevel({[Underlyings].[ALL].[AllMember]})}) ON ROWS

FROM [EquityDerivativesCube]

WHERE ([Measures].[pnl.SUM])

| Underlyings | pnl.SUM |

|---|---|

| Grand Total | -21,223.46 |

| EUR | -14,033.05 |

| GBP | -7,190.20 |

| USD | -5,633.21 |

| JPY | -5,792.54 |

| CHF | 16,675.98 |

| ZAR | -5,250.44 |

Filtering Members that Start With...

If you only want to see currencies starting with letters C to H, you have to perform your query on a filtered cube, not the entire cube. So the query FROM section needs to be updated as in the following:

SELECT NON EMPTY Hierarchize({DrilldownLevel({[Underlyings].[ALL].[AllMember]})}) ON ROWS

FROM

(SELECT Filter([Underlyings].[UnderlierCurrency].Members, ([Underlyings].CurrentMember.Caption>="C" AND [Underlyings].CurrentMember.Caption<="H"))

ON COLUMNS FROM [EquityDerivativesCube])

WHERE ([Measures].[pnl.SUM])

| Underlyings | pnl.SUM |

|---|---|

| Grand Total | -125.49 |

| EUR | -12,757.20 |

| GBP | -8,332.57 |

| CHF | 20,964.28 |

The criteria in the filter section can be more complex to suit specific needs. For instance, you can input more characters to refine your selection. For example, instead of currency starting from C, you can select currency starting from CI.

Filtering Members that End With...

If you only want to see currencies ending with the letter R or beyond, you can update the criteria using the Right function.

To add more letters, you need to increase the index of the Right function.

(SELECT Filter([Underlyings].[UnderlierCurrency].Members,(Right([Underlyings].CurrentMember.member_caption,1)>="R"))

| Underlyings | pnl.SUM |

|---|---|

| Grand Total | -9,153.53 |

| EUR | -7,194.67 |

| GBP | -5,260.58 |

| CHF | 3,301.72 |

MDX keywords member_caption or Caption are interchangeable.

Filter for a Holiday Calendar - Excluding Members from a Hierarchy

Since ActivePivot Live 2.9, filters can be saved as bookmarks. A characteristic use case for this is a holiday calendar to exclude dates from a view of VaR and Business Day, where VaR is calculated MON-FRI regardless, but should not be shown for public holidays.

The following set can be saved as a bookmark and applied to any query.

SET UkWorkingDays AS

Except(

{

[Time].[Valuation Time].[Valuation Date].Members

},

{

[Time].[Valuation Time].[Valuation Date].[Wed Jan 01 00:00:00 CET 2014],

[Time].[Valuation Time].[Valuation Date].[Fri Apr 11 00:00:00 CET 2014],

[Time].[Valuation Time].[Valuation Date].[Mon Apr 14 00:00:00 CET 2014],

...,

...

}

)

The MDX Except function takes a set in the first argument and excludes all members of the set in the second argument.

With the above filter, New Year's day, Good Friday and Easter Monday will be excluded from the Valuation Time dimension (hierarchy in AP5).

Filtering on Measure Values

We can filter members based on a set of conditions on measure values with the IIf function and operators such as AND, OR, >, <.

For filtering based on a single condition, you can simply use the Filter MDX function: see http://msdn.microsoft.com/en-us/library/ms146037.aspx

For instance :

Select all Products that have a contributor count between 50 and 1000,

and all Products with a count above 1000 in a separate column

The MDX query will look like this:

WITH

MEMBER [Measures].[LargeCount] AS

IIF

(

[Measures].[contributors.COUNT] <= 1000

AND

[Measures].[contributors.COUNT] >= 50

,[Measures].[contributors.COUNT]

,null

)

MEMBER [Measures].[VeryLargeCount] AS

IIF

(

[Measures].[contributors.COUNT] > 1000

,[Measures].[contributors.COUNT]

,null

)

SELECT

NON EMPTY

Hierarchize

(

{

DrillDownLevel({[Product].[ALL].[AllMember]})

}

) ON ROWS

,{

[Measures].[contributors.COUNT]

,[Measures].[LargeCount]

,[Measures].[VeryLargeCount]

} ON COLUMNS

FROM [VarCube]

| Product | contributors.COUNT | LargeCount | VeryLargeCount |

|---|---|---|---|

| Grand Total | -20,962 | 20,962.00 | |

| ABCP | 40 | ||

| CDO^2 | 40 | ||

| CDSNthDefault | 40 | ||

| CDSNthLoss | 40 | ||

| CLN CDS | 40 | ||

| CcySwap | 40 | ||

| Convertible Bond | 40 | ||

| Corporate Bond | 472 | 472.00 | |

| Corporate Loan | 72 | 72.00 | |

| Covered Bond | 40 | ||

| Debt Security | 668 | 668.00 | |

| EQ Derivative | 1,713 | 1,713.00 | |

| FX Derivative | 252 | 252.00 | |

| FX Vanilla | 4,502 | 4,502.00 | |

| Government Bond | 1,904 | 1,904.00 | |

| IR Derivative | 4,732 | 4,732.00 | |

| IR Vanilla | 3,787 | 3,787.00 | |

| Money Market | 40 | 3,787.00 | |

| Money Market (CP) | 36 | ||

| Quasi Government | 116 | 116.00 | |

| Single-name CDS | 40 | ||

| Supra | 80 | 80.0 | |

| TRS | 40 | ||

| UNKNOWN | 468 | 468.00 | |

| Vanilla Equity | 1,459 | 1,459.00 |

Filtering on Measure Values in MDX to include/exclude data from a view

To filter a data set on an existing bookmark to only display what you want to filter for, you can inject the MDX query with a FILTER without needing to create new member measures.

The following MDX snippet from a bookmark only showing Bookings and their contributor counts illustrates its use.

SELECT NON EMPTY {

[Measures].[contributors.COUNT]

} ON COLUMNS,

NON EMPTY FILTER(

Hierarchize(

[Booking].[Book].Members

),

[Measures].[contributors.COUNT] > 500

) ON ROWS

FROM [EquityDerivativesCube]

From the Microsoft description of a filter http://msdn.microsoft.com/en-us/library/ms146037.aspx the syntax for a filter is thus:

Filter(Set_Expression, Logical_Expression)

In our example above, the Set_Expression parameter is:

Hierarchize(

[Booking].[Book].Members

)

and the Logical_Expression parameter is:

[Measures].[contributors.COUNT] > 500

This filter will now only allow the display of Booking entities where the contributor count is more than 500.

| Book | contributors.COUNT |

|---|---|

| LONDON | |

| FICC | |

| Euro Credit Derivati... | 616 |

| Rates 2 | 753 |

| NEWYORK | |

| FICC | |

| Rates 1 | 566 |

| undefined | |

| undefined | |

| CNEWBOOK | 960 |

Possible use cases:

- Where a measure such as P&L is below a certain value, and this bookmark may be saved to explicitly display the biggest loss-making desks/books.

- In conjunction with a measure-quality measure where you are only interested in those bookings where the data quality is less than 100%.

For example, [Measures].[pnlVector.QUALITY] < 1 where the pnlVector.QUALITY measure is a percentage of the contributors count.

Measure as Mathematical Formula

Measures can be added with a mathematical formula built with operators and operands (scalars or other measures).

For instance :

Full VaR = Square root of sum of Square of historical VaR and Square of stress VaR

In other words:

fullVaR = (historicalVaR^2 + stressVaR^2) ^ (1/2)

Also, we want to format the result to two decimal places and with a thousands separator, such as 1,123,456.89

The MDX query will look like this:

WITH

/* full value-at-risk combining historical and stress values */

MEMBER [Measures].[fullVaR] AS

([Measures].[historical.VaR] ^ 2 + [Measures].[stress.VaR] ^ 2) ^ 0.5

,FORMAT = '#,###.##'

SELECT

NON EMPTY

Hierarchize

(

{

DrillDownLevel({[ProfitCenter].[ALL].[AllMember]})

}

) ON ROWS

,NON EMPTY

{

[Measures].[historical.VaR]

,[Measures].[stress.VaR]

,[Measures].[fullVaR]

} ON COLUMNS

FROM [VarCube]

| Real-time PushPivot View | |||

| historical.VaR | stress.VaR | fullVaR | |

| Grand Total | 10,495.76 | 10,503.39 | 14,848.64 |

| ProfitCenter_A | 10,495.76 | 10,503.39 | 14,848.64 |

| ProfitCenter_B | 1,124.85 | 1.169.57 | 1,655.03 |

| ProfitCenter_C | 1,225.42 | 1,227.46 | 1,734.45 |

| ProfitCenter_D | 2,101.37 | 2,101.13 | 2,971.62 |

| ProfitCenter_E | 295.74 | 293.94 | 416.97 |

| ProfitCenter_F | 4,698.93 | 4,689.38 | 6,638.54 |

Recurrence Relations

For advanced time series analysis and visualisation use cases, you can use recursive MDX functions.

First let's consider a time dimension where each member represents a unit of time, with a cumulative measure along the dimension, together with a measure summed at each unit of time. The cumulative measure could easily be the accumulated cash value of inventory (cash, pledgeable assets, SKUs, oxen, and so on) and the summed measure could easily be the amount paid for acquisition of inventory at each point in time. This would give an interesting summary of inventory at any point in time.

Perhaps the cash value of inventory does not just accumulate - it may be associated with an opportunity cost, a fixed storage or administrative cost x so that the value of an inventory, unless utilised for some business purpose, decays to zero with some half-life. Such a scenario could easily model the maintenance of a liquidity buffer or the warehousing cost of unsold electronic widgets which otherwise have a nominal cash value. To do this we need an MDX recursive measure with a damping factor.

You can apply the following MDX on the sandbox project to perform such a calculation. Here, pnl.SUM represents the cumulative measure:

WITH

Member [Measures].[Damped] AS IIF(

[Time].[TimeBucket].CurrentMember.PrevMember IS NULL,

[Measures].[pnl.SUM], //this is the base case of the recurrence relation

(

[Time].[TimeBucket].CurrentMember,

[Measures].[pnl.SUM]

) + 0.99 * (

[Time].[TimeBucket].CurrentMember.PrevMember,

[Measures].[Damped]

) // else recurse in the previous member, with a damping factor representing a 1% carrying cost

)

SELECT

NON EMPTY {

[Measures].[contributors.COUNT],

[Measures].[Damped]

} ON COLUMNS,

NON EMPTY [Time].[TimeBucket].[DateBucket].Members ON ROWS

FROM [EquityDerivativesCube]

CELL PROPERTIES VALUE, FORMATTED_VALUE, BACK_COLOR, FORE_COLOR, FONT_FLAGS

This gives a useful graph on which different assumptions can be tested on the fly, without IT support, such as:

- "What happens to my bottom line if the per unit cost of storing an unsold tablet rises from 1% per time unit to 5%?"

- "What is the opportunity cost imposed by my excess liquidity buffer if interest rates rise by 1%?

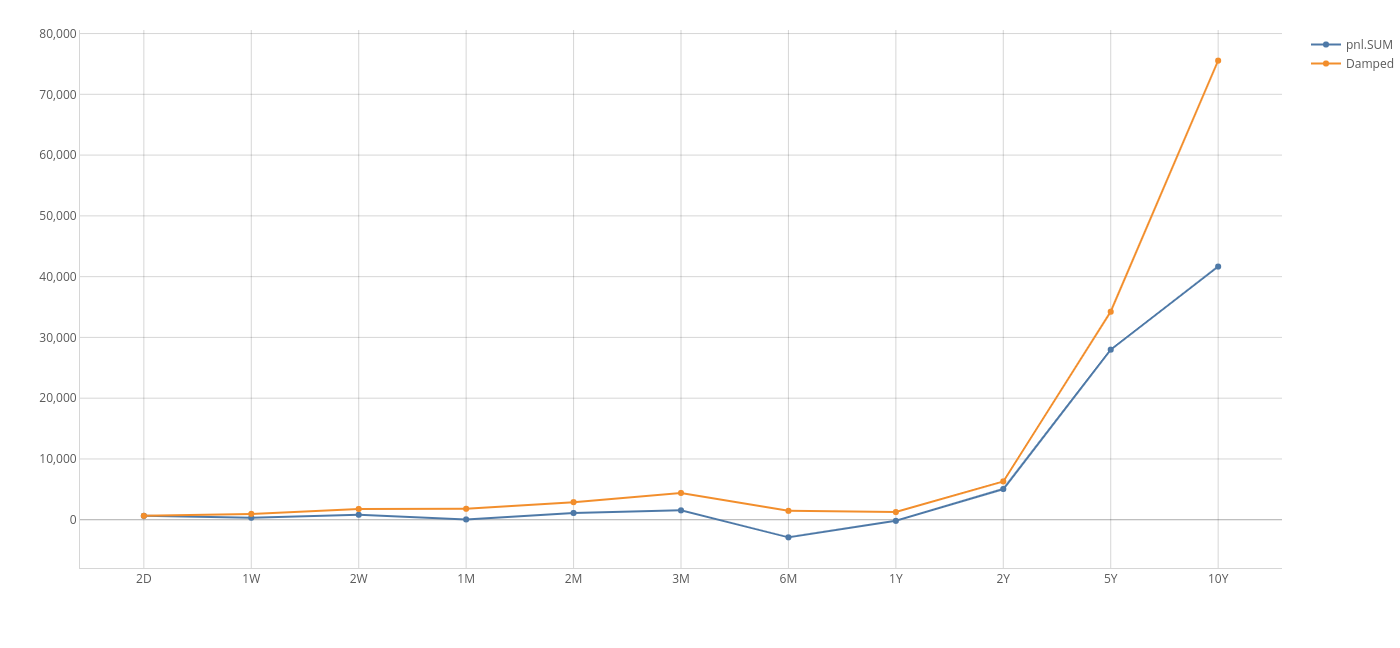

Below is a comparison between accumulation in the presence of costs and with a 1% carrying cost.

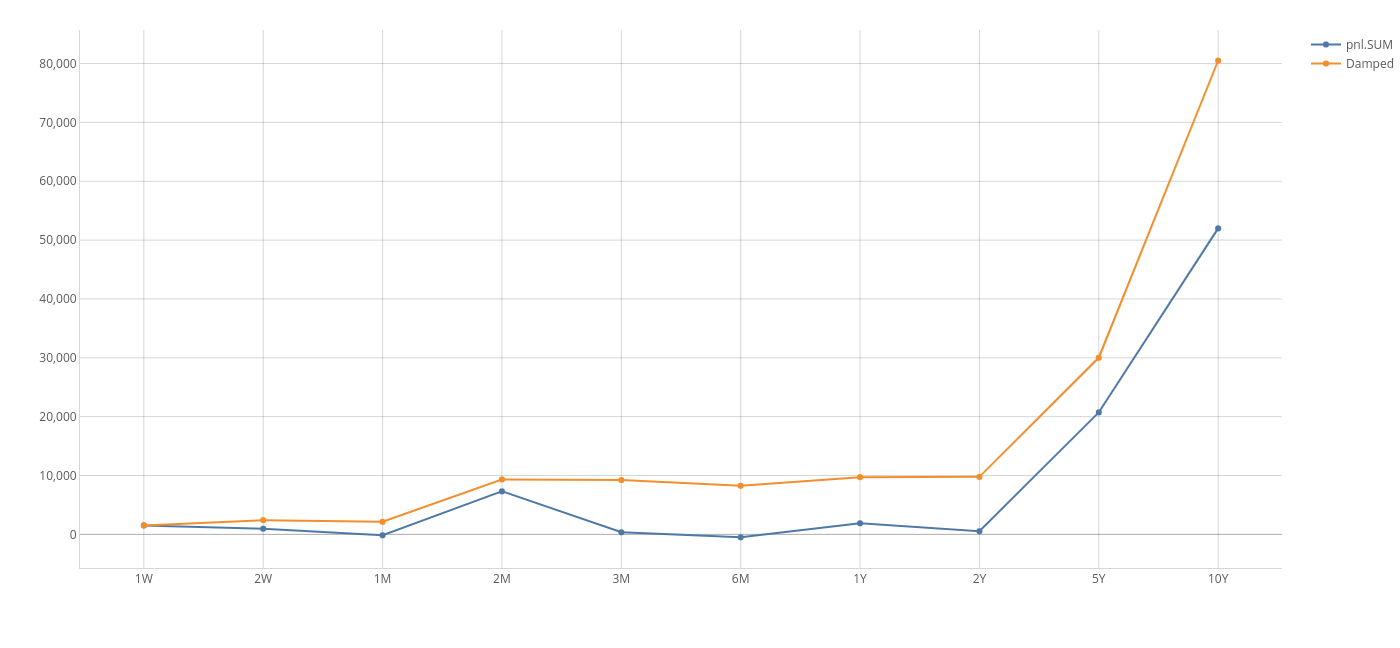

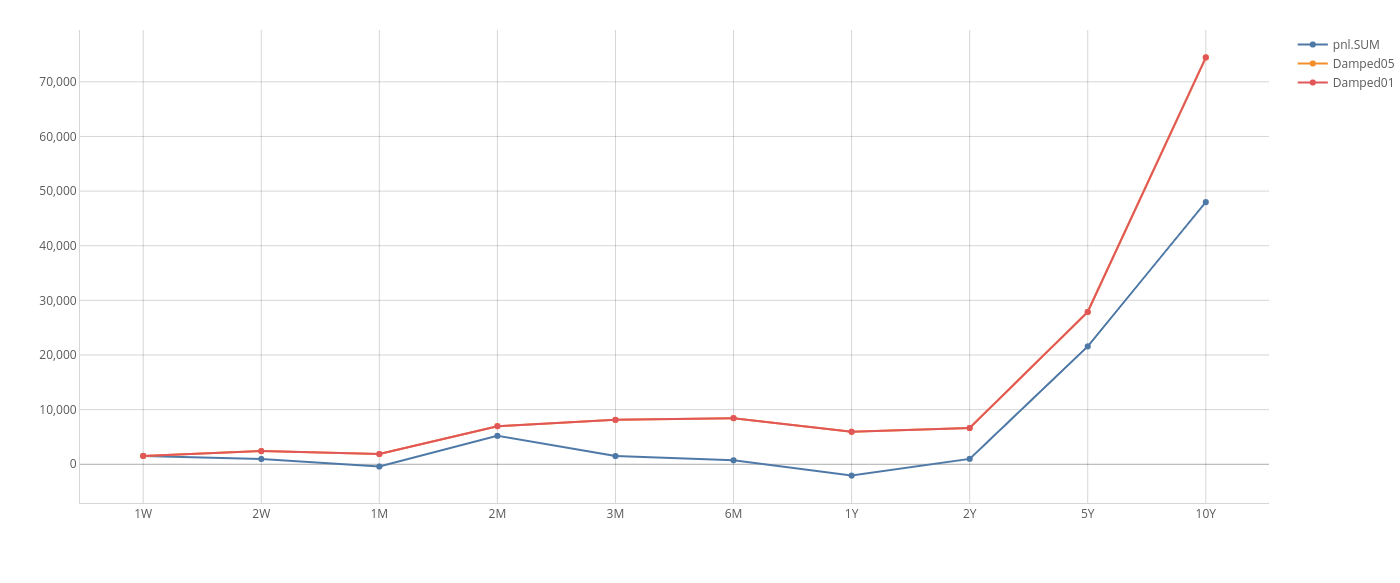

Below is a comparison between a 1% carrying cost and a 5% carrying cost.

When using recursion you need to be careful to ensure that your relation terminates and has low computational complexity - otherwise you will invariably produce a stack overflow!

Only Show VaR for Trades not Present the Previous Day

WITH

Member [Measures].[New Trades VaR] AS IIF(

(

[DAY].CurrentMember.NextMember,

[TRADE_ID].CurrentMember,

[Measures].[contributors.COUNT]

) > 0,

NULL,

[Measures].[VaR]

)

SELECT NON EMPTY (

[DAY].[DAY].Members,

[Measures].[New Trades VaR]

) ON COLUMNS,

NON EMPTY

(

[TRADE_ID].[TRADE_ID].Members

)

) ON ROWS

FROM [YOUR_CUBE]

This example works for trade-level VaR. To calculate the VaR for all trades not present the previous day, the measure would need to be the sum of the VaR Vector, which could then be fed into a post-processor to calculate the percentile.

Top 3 Underlyings per Country

You may know the TopCount function, which is helpful when you want to only keep the members with the highest values.

Now, imagine that in your cube you have the dimensions Underlyings and Geography and you want to retrieve for each region the three underlyings with the highest PnL.

You cannot do this solely with TopCount, you also have to use Generate. This functions acts like a For loop.

Here is the MDX that will do what we want:

SELECT

NON EMPTY

Generate

(

[Geography].[Region].MEMBERS

,TopCount

(

{[Geography].CurrentMember} * [Underlying].[ALL].[AllMember].Children

,3

,[Measures].[TotalPnl.SUM]

)

) ON ROWS

,{[Measures].[TotalPnl.SUM]} ON COLUMNS

FROM [PnlCube]

| TotalPnl.SUM | ||

|---|---|---|

| Asia | 600728 | 0 |

| Europe | IAP BARC BRBY | 6,559 1,899 9,33 |

| North America | AAPL GS GE | 16,584 1,434 -36 |

Here is how we can add the total per region:

SELECT

NON EMPTY

Generate

(

[Geography].[Region].MEMBERS

,{

{

([Geography].CurrentMember, [Underlying].[ALL].[AllMember])

}

,TopCount

(

{[Geography].CurrentMember} * [Underlying].[ALL].[AllMember].Children

,3

,[Measures].[TotalPnl.SUM]

)

}

) ON ROWS

,{[Measures].[TotalPnl.SUM]} ON COLUMNS

FROM [PnlCube]

| TotalPnl.SUM | |

|---|---|

| Total Asia | 0 |

| 600728 | 0 |

| TotalEurope | -25,841 |

| IAP | 6,559 |

| BARC | 1,899 |

| BRBY | 933 |

| Total North America | 10,986 |

| AAPL | 16,584 |

| GS | 1,434 |

| GE | -36 |